We are only as strong as the weakest link in our performance. That’s whilst we should focus on our strengths we also need to learn how to manage our weaknesses.

One of my traders from the Prop Trader Training had the experience that after a run of profitable trades the point would come when he would let a loss run too long and wipe out all the profits from the winning run. “The biggest weakness that I am working through is how to apply the same process after a winning run.”

The answer to this is found in the concept of the Emotional Pendulum. (The Emotional Pendulum, and comes from the work of David Pellin, a Canadian psychotherapist from the 1960s, and Peter Fleming, who carries on Pellin’s work at the Pellin Institute in the UK.) http://www.pellin.org.uk/CTIntro/Paper1.pdf

Now, when it comes to the spectrum of emotional stability there are three extreme points on the scale: Low Negative, Neutral Centred and High Positive.

Swings of the Pendulum

David Pellin made the observation that, “the motion of emotion is like the swing of a pendulum.” A pendulum swings back and forth from high to low until it eventually rests in the centre, still and calm, until some outside event sets it off to swing across the whole spectrum once again.

Most traders tend to experience the whole spectrum from low negative to high positive but never get to rest in neutral centre. Unless they learn to manage those swings their trading results stay as inconsistent as the swings of the pendulum.

High positive relates to extreme levels of excitement, enthusiasm and happiness – a state commonly experienced after a winning run, and low negative relates to any feeling that resembles anger, sadness or even depression – a state commonly experienced after a string of losses.

When you are in a state of neutrally centered you are being fully present, focused and in a highly conscious state. That is the place from where you are able to make great trading decisions and therefore big profits consistently like clockwork.

The extent that our trading bank is going to be hurt by self-pity or smugness will depend on how far we swing on the pendulum. The further we swing to either extreme the more money we are prone to lose.

So, in the case of my prop trader, he had a great winning run, most probably started believing that he has finally made it, dreaming of the millions of dollars he will generate with trading, hearing the world cheering him on as he buys his wife the most beautiful diamonds and himself a hot Maserati. And as Donald Trump says, that is the moment when you take the eye off the ball, you fall in love with the numbers on your bank balance, or the % return on your statistics, and suddenly your analysis starts to get sloppy and you start getting lose on your risk management because preserving the nice numbers on your statistics suddenly becomes the focus instead of working with what the market has to offer and focusing on flawless execution.

Why is that so?

The Impact of Highs and Lows

In her book ‘Molecules of Emotions’ Candice Perts explains that we have receptors in our brain – called opiate receptors, that create the signal for being high when taking drugs or drinking alcohol. And these are exactly the same receptors for our emotions. So, the receptors you have for feeling sad angry depressed happy excited or invincible are essentially the same receptors you use when you drink alcohol or take drugs.

What that means is that science is telling us that when you are experiencing an emotional state you are in fact intoxicated.

So when you are high as a kite, do you become more focused, concentrated and conscious or less? Less, right? Alcohol is a filtering system so typically you see things differently than the sober people around you. It is kind of looking at a chart in hindsight and wondering why on earth you took this trade. Even though at the time it looked so promising.

Now, just in case you don’t’ believe me: think about it, have you ever gotten completely drunk and done something stupid and then sobered up and gone – oh man, what did I do?

Or do you know anyone who was so excited that they blurred something out and then afterwards they are like oh no, I can’t believe I said that?

And on the flipside, has anyone ever been so angry they have done or said something totally inappropriate and then you ‘sober up’ get back to neutral and you go oh man what was I doing?

And the same occurs in trading: have you ever entered a trade on impulse and immediately thought to yourself: Oh no, what did I do that for? Stupid question, of course you did, we all have.

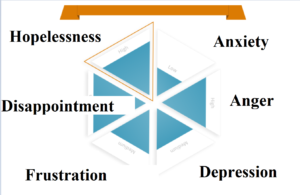

Swing to the Lows

The negative low area of the pendulum is the result of emotional depletion triggered by already evident low self-image or physical or physical depletion and exhaustion because having concentrated over a long period of time willpower gets eroded as well. The low is then usually intensified by subsequent trading losses and frustration.

In the negative low your emotions are turning inwards. Twisting and turning on each other, becoming convoluted, with the mental sabotage that you are alone with these emotions, with these problems and that solutions are not possible. Many stay stuck in the negative low focusing on the imperfectability of oneself, the impossibility of ever achieving ones dream and becoming a successful trader.

In the low, you can only be aware of yourself as a failure or a victim. In the low, your mind convinces us that this is the truth.

If your low is sufficiently deep, you can turn a genuine trading loss into a sincere belief that you have serious problems with self-sabotage, or that you are just not cut out to be a trader..

You need to have an awareness of the process that is happening. When you are low your thinking will be clouded and your decision making impaired. So it is important to find ways that lead back to neutral centred where you can operate with crystal clarity and laser like objectivity.

Swing to the Highs

After a string of successful trades the un-self-aware trader is swinging high compulsively, they often feel invincible and can hardly bear to be interrupted in their trading. This is often obvious to the outside observer but not to the trader himself. I call this state Super(wo)man syndrome.

The energy rush towards the compulsive high takes away your ability to be logical, calm and diligent. Your focus shifts back to wanting more of the good feeling, getting attached to the nice numbers on your trading stats or your bank balance and so you shift away from focusing on flawless execution of your trading system which might spoil the nice numbers. You start rushing, short cutting the process intoxicated by that feel good feeling of the last win.

Similarly, if you have a string of losses, you don’t like it and that leads to you not wanting to feel that unpleasant feeling and so you try to force your way out by taking second rate trading setups which in the end just leads to more losses and quickly you once again feel stuck in a vicious circle.

In both cases your focus shifts away from flawless execution of your trading system.

When you are being highly positive, then your brain will block out 50% of your reality to remain positive, excited and happy. Your objectivity is clouded, you only see great trade setups but the Super(wo)man filter doesn’t let through the warning signs that the great setup might fail because the focus has shifted from diligent execution to feeding the addiction for that feel good sensation.

And that is the reason why after a string of winners traders often get a really bad trade. Consequently after the exaltation of the high they skid to the opposite side of the spectrum, feeling sad and depressed.

Now the same thing happens again. The sadness filter is now filtering out all the positive things in your trading reality in order to maintain that perspective. You can’t remember past good trading results, you don’t see the progress you have made over the years and you feel you will never make it. All you can see is your dreams floating away and with every losing trade you pick you essentially become a losing trade magnet.

I mean, think about it, how do you pick trades when you are in a highly excited state? You are blinded by the promise of riches and good and you will ignore every possible warning sign that the trade is about to turn into a bad loss? Traders who are already progressed with their self-awareness or mindfulness work actually report that they have fleeting thoughts such as I should stop now or I don’t know it doesn’t feel right or similar thoughts but didn’t listen to them.

And then sure enough low and behold it all turns to crap.

Or have you ever seen a great trade setup and were so pessimistic and thought this will never work, so you don’t take it and then that was the trade the trade of the day? Anyone relate to that? Of course you do..

And then the next trade sets up and because you missed out the last time you jump in and low and behold the trade once again turns to crap. And now the vicious circle has begun you now stop following your strategy but try to force things and everything just gets worse and you start doubting yourself once again, if you will ever make it.

This all only happens when you are operating from either end of the emotional pendulum. Moving back into a neutral calm mind, perhaps you can now see that the market conditions have changed or that all you need to do is refocus on a flawless execution of your strategy, and that losses are just part of the business expense and that even the best traders have a bad day that it might be uncomfortable yet ordinary and part of any professional trader’s life.

Perhaps in the neutral centered state you can draw on the deep knowledge that you had great trades in the past and that the good times will come and go as the bad streaks come and go.

When you are in neutral centered, you have all of these amazing things happening to you. There is no more self-talk going on, there is just watching the charts and quiet observation, no frowning, no biting lips, no grinding teeth, just purpose, grace and ease.

Your true strength as a trader lies in your awareness of where you are on the scale of your emotional pendulum after each trade and then quickly readjust before taking the next trade. The good news is anyone can learn to avoid those extreme highs around which your trading accounts and egos get hurt.

Within the neutral centered-ness of calm lies your incredible ability to recuperate, adapt, to keep going in the fact of surprising change.

I promote mindful consciousness in trading, because the more mindful and conscious you become the faster you are able to move back to the neutral centred calm state and the more your results will improve.

Now, who is up for making more money with trading? Of course, seems pretty obvious, it’s everyone, that’s why you are reading this.