This was my newsletter from April 10, 2012..

Is The Mass Pressure Chart Doing It’s Forecasting Magic Again?

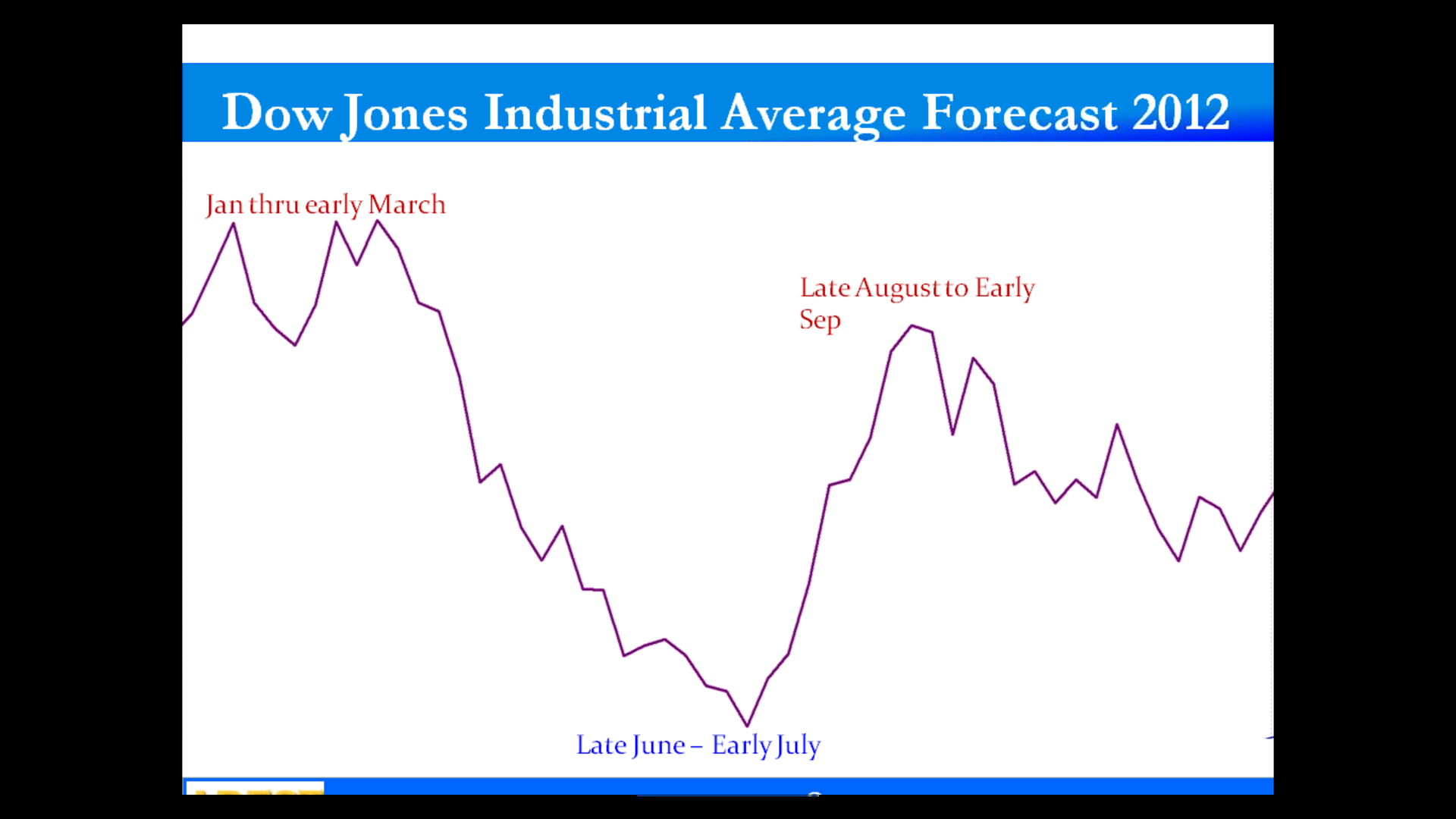

W.D. Gann believed that the future was just a repetition of the past and every beginning of the year he would draw up a chart forecast turning points and trends based on the market movements 80 years earlier. So this 2012 chart is based on the markets from 1932. Interesting huh? Unfortunately I can’t remember whom I got this chart from. It was either Larry Williams, Jake Bernstein or David Hunt.

I have been following those forecasting charts for a few years now and in conjunction with my technical analysis it has been extremely useful.

In comparison you can check out Larry Pesavento’s forecast once again which is still on my website to be found at www.tradingpsychology.com.au/2012/01/larry-pesavento-2012-forecast; it is very similar. It fascinates me again and again how the markest follow mathematical calculations such as fibonacci’s retracement calculations and seasonal behaviour.

TraderMind Webinar Program

6 interactive webinar training sessions over 6 consecutive weeks full of little known information, mind blowing insights and practical proven techniques that Steve uses to train his top trading clients. I love that Steve always shares inspiring stories of top traders, elite athletes and world class poker players that he worked with to illustrate the practical application behind the teaching. Your training starts on enrolment with loads of pre-course material in preparation. Live Question and Answer session at the end of each training. 6 interactive workbooks, yes you will have to do some work with follow up activities to implement what you have learned. Thank god, webinars are recorded, I guarantee that you won’t be able to process all the information provided in one go. And the best bit: 1-1 email support from the man himself to help you to implement your learning into the reality of trading. As Rome wasn’t built in 1 day either you will as a bonus be part of the post-course mentoring group. 95% of traders who have attended Tradermind describe the program as having helped them to improve their trading performance by at least 30% and hence proudly recommend the TraderMind program to another trader. Find out more or you can book directly on Steve’s website www.highperformanceglobal.com/tradermind/

Want To Know What I Got Out Of TraderMind?

- 6 x 60 minute webinars packed with information, insights and ideas to implement from performance psychology, neuroscience, behavioural finance and cognitive behavioural coaching. – and lots of little gems from Steve’s personal experience of working with the top traders in the world and how they achieved those levels of performance. I just love listening to those inspirational stories of how other traders and also elite athletes Steve used to work with in the past overcame their challenges and succeeded.

- Each webinar is recorded so you can listen again, or catch up if you missed it.- Out of my personal experience those 1 hour sessions and the 30 min Q&A are so intense that I had to listen to them 3 or 4 times to process all the information and to implement the pragmatic tools. Full on but certainly reflecting in the P&L!

- There is a LIVE question and answer session at the end of each webinar – It is usually the Q&A part where traders ask questions about how to deal with difficulties that they have encountered where I had a lot of “lightbulb” moments. Steve uses this part of the program to explain the practical application of the theory into the trader’s real life.

- You get 1-1 email coaching support throughout the program from Steve himself. – I love e-coaching! This was where I got the most benefit from. We all know what to do but we don’t really know how to implement the theory into our personal life circumstances. For example, we all know we should cut a losing trade, but in the heat of the moment with all our hopes and fears interfering I often had difficulty to stop hoping to save my trade and at least get out square just to end up in a massively painful loss. In the e-coaching Steve taught me what to do specifically within the context of my individual circumstances in order to perform at the highest levels and to stop doing stupid things. Also, often when I did stuff up in trading I wasn’t quite sure how to fix it. It is a great advantage to be able to email someone and get clarity. Also e-coaching is so much more efficient and as we say in NLP “A problem well defined is a problem half solved” and when I have to structure my thoughts into written words my brain already starts shifting. When Steve sends me back his questions or comments I then can process those first and ponder about the answers instead of having to come up with something quickly and then afterwards regretting that I actually meant to say something totally different.

- To help you condition your trading behaviours you will also receive the Mental Training For Trading Success audio downloads worth £89.95 – I personally use them a lot especially as I am not great at meditation they do help me to quiet and refresh my mind during a big trading session and also I use the Get into the Trading Zone in order to keep me balanced and avoid Superwoman syndrome after having had a great run. You can find lots of info on www.highperformanceglobal.com/download

- Workbooks for every session

- Pre-course learning materials – now that is new for this year’s program so I can’t comment on it as yet

- Post-course mentoring – This is also newly added but I am a member of the HPT Group and therefore know what to expect. The post course mentoring is like having a real life coaching session with Steve. It is the practical application of everything we have learned in the TraderMind program. You are very lucky, because in this edition of the TraderMind program you will be able to solidify your psychological framework supported by Steve with the post-course mentoring program. You can find more info on www.highperformanceglobal.com/hpt-group.

Content

Week 1 : Thursday 19th April : Trading To Win: Becoming A High Performance Trader

Week 2 : Thursday 26th April : The Attention And Awareness Advantage : How To Develop Greater Self-Control And Stronger Discipline

Week 3 : Thursday 3rd May : Thinking Differently: Decision Making and Discipline Under Conditions Of Risk And Uncertainty

Week 4 : Thursday 10th May : Enotional State Mastery : Overcoming Fear, Dealing With Stress, Building Confidence

Week 5 : Thursday 17th May : Trader Toughness Training : Dealing With Losses, Setbacks And Errors

Week 6 : Thursday 24th May : Breakout : Overcoming Challenges And Raising Your Game

If you have any further questions regarding the program please do not hesitate to get in touch with Steve at info@highperformanceglobal.com.

I hope you enjoyed this newsletter.. with a toast to your trading profits

Mandi